The study involved major activities in estimating the current market size for the intelligent robotics market. Exhaustive secondary research was done to collect information on the intelligent robotics market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the intelligent robotics market.

Secondary Research

The secondary research for this study involved gathering information from various credible sources. These included company annual reports, investor presentations, press releases, whitepapers, certified publications, and articles from reputable associations and government publications. Additional data was obtained from corporate filings, professional and trade associations, journals, and industry-recognized authors. Research from consortiums, councils, and gold- and silver-standard websites, directories, and databases also contributed to the qualitative framework. Key global sources such as the International Trade Centre (ITC) and the International Monetary Fund (IMF) were consulted to support and validate the market analysis.

Primary Research

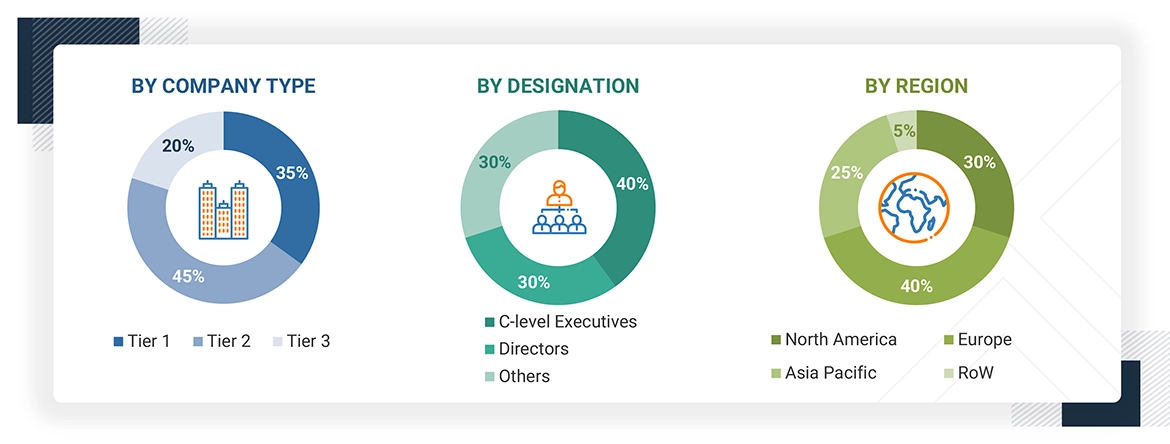

Extensive primary research has been conducted after gaining knowledge about the intelligent robotics market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand side (end-use industries) and supply side (equipment manufacturers, integrators, and distributors) across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted with the parties on the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report uses top-down and bottom-up approaches to estimate and validate the intelligent robotics market size and the size of various dependent submarkets. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research processes. This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts such as CEOs, VPs, directors, and marketing executives to obtain key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through the primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed input and analysis from MarketsandMarkets, and finally, the data has been presented in this report. The figures given below show the overall market size estimation process employed for the purpose of this study.

Bottom-Up Approach

-

Identifying end users who are either using or are expected to use intelligent robotics

-

Analyzing major providers of intelligent robotics and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

-

Analyzing historical and current data pertaining to the market, in terms of volume, for each product segment of the intelligent robotics market

-

Analyzing the average selling price of intelligent robotics based on different technologies used in different products

-

Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

-

Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

-

Tracking the ongoing developments and identifying the upcoming ones in the market that include investments, research and development, product launches, collaborations, and partnerships undertaken, and forecasting the market based on these developments and other critical parameters

-

Carrying out multiple discussions with key opinion leaders to understand intelligent robotics and related raw materials, as well as products designed and developed to analyze the breakup of the scope of work carried out by the key companies’ manufacturing panels

-

Verifying and cross-checking the estimate at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

Top-Down Approach

-

Focusing on top-line investments and expenditures being made in the ecosystems of various end users

-

Calculating the market size considering revenues generated by major players through the cost of the intelligent robotics systems

-

Segmenting each intelligent robotics application in each region and deriving the global market size based on region

-

Acquiring and analyzing information related to revenues generated by players through their key product offerings

-

Conducting multiple on-field discussions with key opinion leaders involved in developing various intelligent robotics offerings

-

Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region, and the types of intelligent robotics systems used in robot type, mobility, and application

Intelligent Robotics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market size has also been validated using the top-down and bottom-up approaches.

Market Definition

Intelligent robotics is the field that focuses on creating robots capable of perceiving, understanding, and reacting to their environment autonomously, often using techniques such as machine learning and artificial intelligence. These robots can execute programmed tasks, learn from experience, adapt to new situations, and make decisions based on their understanding of the world.

Key Stakeholders

-

Original equipment manufacturers (OEMs)

-

Technology solution providers

-

Research institutes

-

Market research and consulting firms

-

Forums, alliances, and associations

-

Technology investors

-

Governments and financial institutions

-

Analysts and strategic business planners

-

End users and prospective end users

-

Regulatory bodies and industry associations

Report Objectives

-

To define, describe, segment, and forecast the size of the intelligent robotics market, by mobility, robot type, application, and region, in terms of value, and robot type in terms of volume

-

To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

-

To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To provide a value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter’s five forces analysis, investment and funding scenario, and regulations pertaining to the market

-

To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

-

To analyze opportunities for stakeholders by identifying high-growth segments of the market

-

To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive market landscape

-

To analyze strategic approaches, such as product launches, collaborations, and partnerships, in the intelligent robotics market

-

To analyze the impact of the macroeconomic outlook for each region, Gen AI/AI, and the 2025 US tariff on the intelligent robotics market

Available Customizations

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Intelligent Robotics Market